[Survey] In 2024, 77% of domestic workers in Hong Kong are actively saving, and 81% have low depression, which suggests they have better support and financial habits.

Enrich HK & HKU SWSA 2024 Survey: Insights into the Financial Health and Well-being of Migrant Domestic Worker Community in Hong Kong

In partnership with the University of Hong Kong, Enrich has produced its annual survey in 2024. The purpose of this survey was to draw a cross-comparison with results from 2023 and to highlight the financial health and well-being of migrant domestic workers (MDWS) in Hong Kong, as well as to draw insights and best practices that could facilitate financial freedom and literacy for the community.

The survey was conducted online from October to November 2024, with a total of 400 respondents who are still actively working in Hong Kong. Respondents originated from Indonesia, Philippines, India, Sri Lanka, and China. This survey mainly focused on the following key pointers: money management, financial inclusion and retirement, financial literacy, and working and living conditions.

- Respondents

In comparison to last year, we noticed an uptick in survey intake – in 2023, we saw 42 Indonesians and 98 Filipino domestic workers who are actively working in Hong Kong, participated in the survey. This year, we collaborated with multiple NGOs and networks to ensure wider coverage of data collection and obtained 140 Indonesian and 256 Filipino respondents and a total of 400 including 4 migrants from different origins. Most of the respondents were female (98%). Average respondent was female, aged around 40.6, had been working for 9 years, with an average duration of daily working hours about 13.4.

In comparison to 2023, the sample characteristics are quite similar, where the average respondent was also female, aged around 39.3, working for about 8.4 years, and working about 14.1 hours per day.

- Money management

We examined the overall landscape of financial management amongst Filipino and Indonesian MDWs.

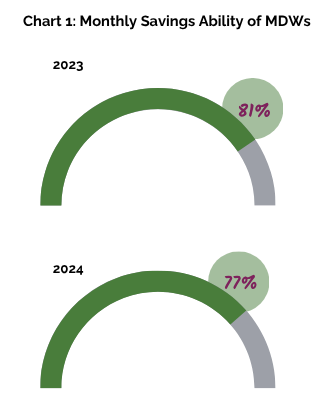

In 2023, we asked two questions pertaining to savings:

- Have you been able to save after the fifth [COVID] wave (May 2022-now)? (Result: 60% were able to save)

- Do you set aside a certain amount of money from your salary every month for your savings? (Result: 81% were able to set aside every month)

Question 2 was asked in 2024 as well. We found that there was a slight decrease to 77% being able to set aside their savings once a month.

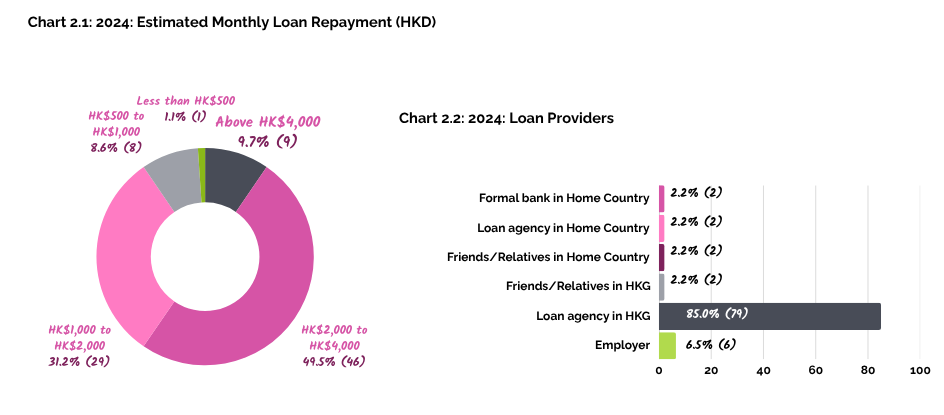

In terms of debt repayment, we saw that amongst those who currently have active loans, about 81% were paying about $1000 - $4000 per month, costing from 20% to almost 100% of their salary per month. Of all those with active loans, the majority (of 85% obtained the loan from loan agencies in Hong Kong.

- Financial inclusion and retirement

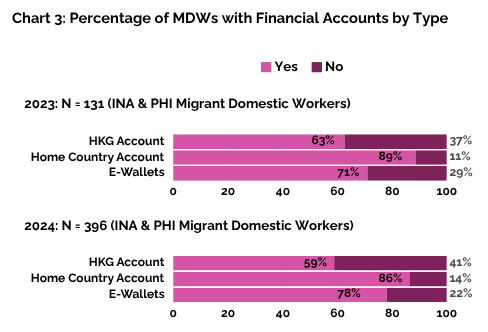

We conducted across-comparison between 2023 and 2024 regarding financial account ownership across three financial products; bank accounts in Hong Kong, origin country (Indonesia / Philippines), and e-wallets. Compared to 2023, we see an uptick in use of e-wallets and a general decrease of bank account participation in both Hong Kong and in the home country, although overall use of bank accounts in the home country remains the most prevalent.

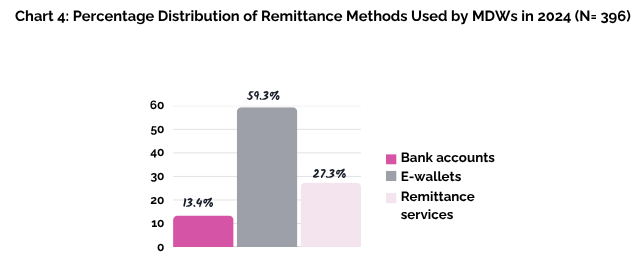

This year, we also collected data about the channels for sending remittances. We also observed that remittances were mostly sent out through e-wallets, sitting at about 59.3% percent.

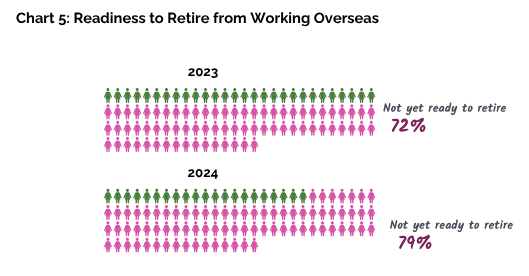

Retirement readiness from overseas work covers factors like having saved enough money, setting up a small business back home, potential job waiting upon return, actual retirement funds, and clear communication with family about upcoming return. In terms of readiness to retire (i.e., stopped working overseas), we observe an uptick from 72% to 79% of migrants not being ready to retire.

- Financial Literacy

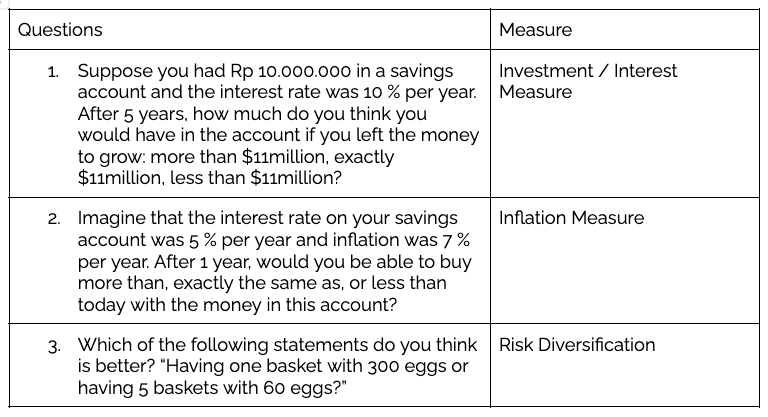

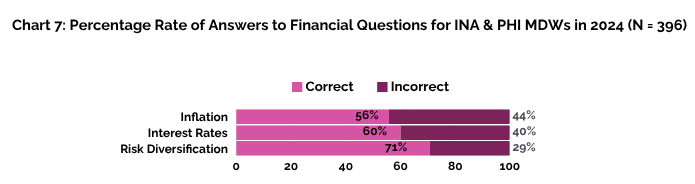

We asked three questions covering the topics of Savings, Investments, and Risk Diversification to analyse the financial literacy levels of MDWs in Hong Kong. If they can answer all correctly, we categorize them as ‘Financially Literate’, one to two correct responses were coded as ‘Financial Beginner’, and with none as ‘Lacking Financial Literacy’.

The following are the questions and mapping onto financial competencies.

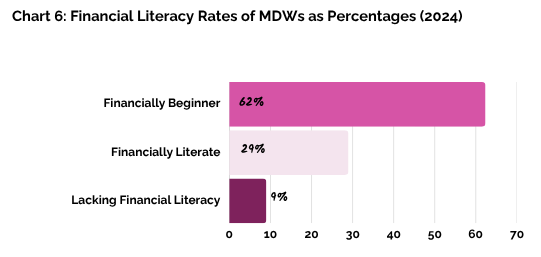

Overall, around 62% of migrants were able to answer 1-2 questions correctly (Financial Beginner), with around 29% able to answer all correctly (Financially literate), and 9% incorrectly (Lacking Financial Literacy).

The “Risk Diversification” question had the most correct answers at about 71%.

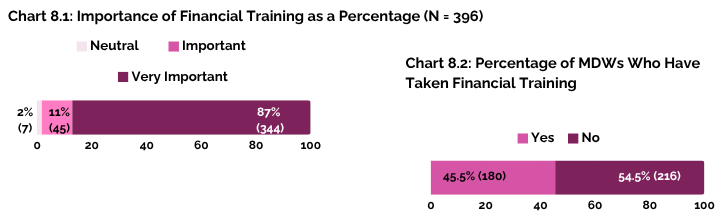

This year, we also asked questions regarding financial training and how they view its importance. Most respondents regard it as either ‘Important’ or ‘Very Important’, indicating a great interest in financial training. However, less than half (46%) have attended financial training at the time of the survey.

In terms of knowledge gained from attending the financial training, more than half could recall the types of savings and investments. In terms of skills that can be practised, more than half signified setting goals and budgeting.

- Work and Living Conditions

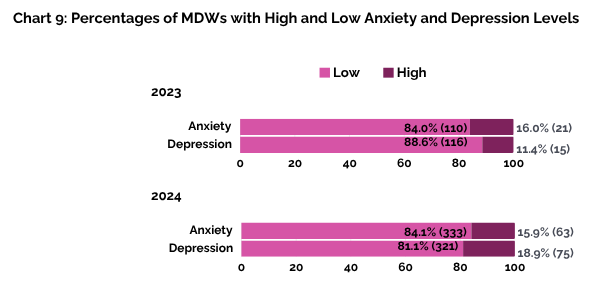

We screen for mental health symptoms using GAD-2 (Generalized Anxiety Disorder) and PHQ-2 (Patient Health Questionnaire) to measure anxiety and depression respectively. As illustrated below, we see that in both 2023 & 2024, most of the respondents are classified as not anxious or depressed. Although there is a slight increase in the proportion of migrants who are classified as ‘High’ in the Depression and Anxiety Scale.

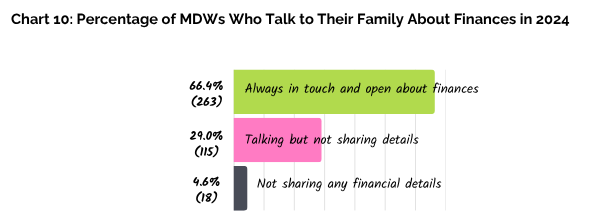

We also asked about the migrants’ communication with their family on finances and found that about two-thirds (66%) were always in touch and open about their finances.

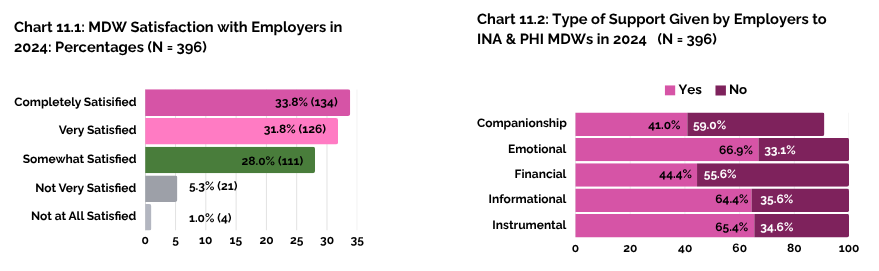

In relation to employers, we asked questions about work satisfaction and observed that around 60% of the migrants are satisfied with their employers.

Lastly, the MDWs were asked about the support given to them by their employers, and more than half indicated they were given emotional, information, and instrumental support, while a lower percentage of 40% received companionship or financial support.

- Conclusion

The findings show that MDWs demonstrate basic financial knowledge and a commitment to saving, but there are still gaps in financial literacy that may hinder their long-term financial security.

Savings habits vary, with some workers actively setting aside money for future needs, while others struggle due to limited income and financial obligations particularly to families. Financial inclusion remains a challenge, as not all MDWs have access to formal banking services, reflected by the decline in bank account ownership in 2024, which may resort to turning to informal savings methods that may not be secure or efficient.

Debt is still a significant concern, with some workers taking on loans to cover recruitment fees, family needs, emergencies or peer pressure. High-interest rates, exploitative loan terms and limited financial education often exacerbate their debt burden, making it difficult to achieve financial stability. Additionally, many migrant domestic workers lack access to resources that may provide structured retirement plans and options, relying primarily on personal savings or family support, which may not be sufficient for their long-term needs.

Financial education has been life-changing for many MDWs enabling them to manage their earnings wisely, reduce debt, thrive in their work and plan for a secure future. With greater financial confidence, they may experience less stress, make informed decisions, and even support their families more effectively. This positive transformation also benefits employers, as financially empowered helpers are often more focused, motivated, and secure in their roles. A stable and financially confident MDW contributes to a more harmonious household, fostering trust, reliability, and mutual respect. Investing in financial education not only uplifts helpers but also creates a supportive and thriving home environment for everyone.

- For the summary findings of this survey, please view the brief report.

- For the summary findings of 2023, please view the brief report.

- Learn about how you can sponsor your helper to join our workshops.

- To learn more about HKU SWSA, visit their website.